how to open tax file in bangladesh

As your taxable income is below BDT 1500000 so you will get tax rebate 15 on the full investment allowance. File your tax return.

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

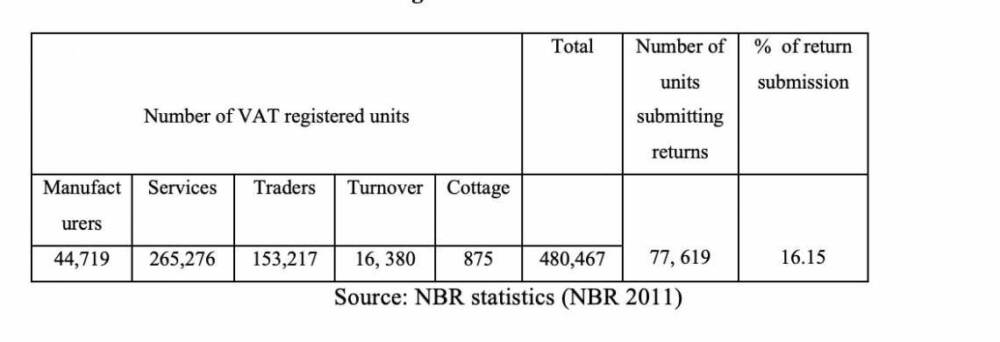

In the budget for the 2006-07 fiscal years government had estimated total tax revenue of 42915450 million taka including both NBR and non NBR revenue of total receipt of 76558618 million taka which is 616 of total receipt of the country.

. At First Visit the Website httpssecureincometaxgovbdTINHome. It was established by the father of the nation Bangabandhu Sheikh Mujibur Rahman under Presidents Order No. We FM Consulting International are providing services to both resident and non-resident to calculate the tax liability and file the return and submit the return.

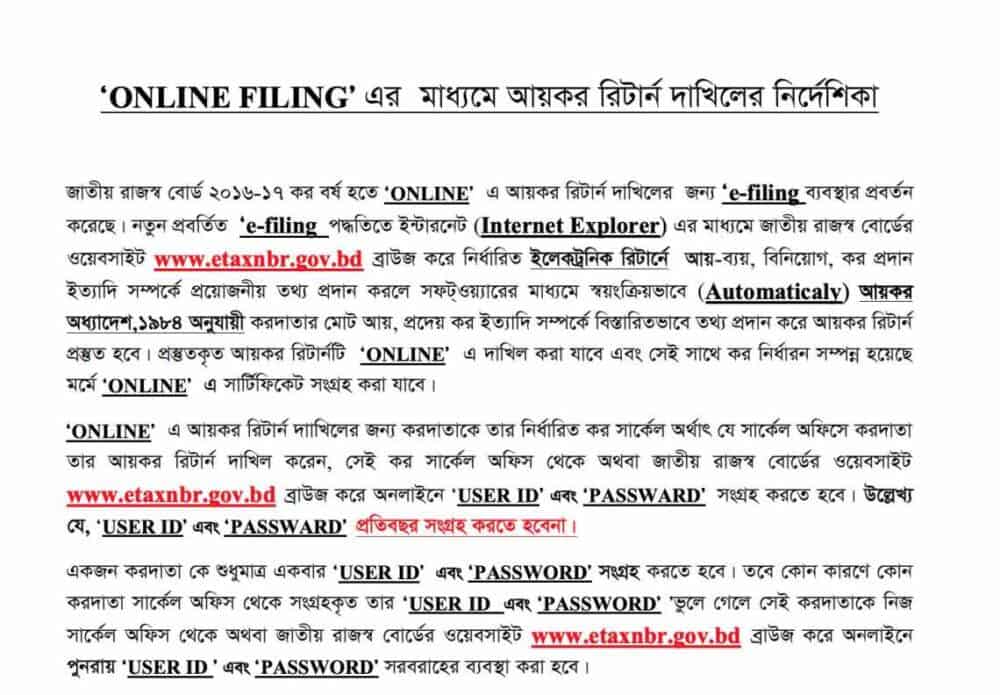

How to submitfile income tax return in Bangladesh Income tax is one of the main sources of accumulation of revenue by the government. Access the online tax filing system here link is external. Tax return filing and tax payment relief measures COVID-19 Bangladesh.

Tax return filing and tax payment relief The government on 7 May 2020 approved draft legislation to extend the time for taxpayers to file their tax returns and to pay their taxes as relief measures in response to the coronavirus COVID-19 pandemic. Tax In Bangladesh Step 1. Apply for an e-TIN.

The typical eTIN number is 12 digit and if you had any TIN numbers before. Complete and submit an application form which can be found here link is external to. Now people of Bangladesh can open their eTIN account within just 10-15 from online.

Out of this profit only income tax will generate 8500000 million taka which is 111. Create a User ID by proving necessary informations in the Registration form. Bangladesh Tax Return Filing And Tax Payment Relief Kpmg United States Dshgjf5ccwq4zm Share this post.

Income Tax BD an Income Tax Consultancy service provider in Bangladesh Since 2011. If you are a withholding agent update your source tax deposit. And at 10 if the taxable income exceeds that limit.

Whose total income during the respective income year exceeds the maximum limit which is not-chargeable to tax under the Income tax ordinance 1984 or if he was assessed to tax for any one of the last three proceeding year. For Tax Submission in Bangladesh each assessee shall deposit the amount to the govt after assessing the amount of income tax. Tax paid by individual tax payer or by corporate entity on the basis of taxable income to the government exchequer at the end of an income year is income tax.

The system displays an online account registration application and Taxpayer saves application form to his computer. In some Condition individual tax payers must obtain TIN Certificate and file the tax return to DCT. However any non-resident Bangladeshi may file his return of income along with bank draft equivalent to the tax liability to the nearest Bangladesh.

Manage your source tax for withholding agents Interact online with tax support team. Register as a taxpayer. Exchequer by pay order challan treasury or online via wwwnbrepaymentgovbd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned.

However in cases where dividend is payable to a shareholder resident in a country with which Bangladesh has signed a tax treaty the rate mentioned in the tax treaty will apply subject to certification from National Board of Revenue NBR. A branch company shall withhold tax at the rate of 20 while remitting profit to Head Office. The National Bureau of Revenue NBR of Bangladesh has fastened the process of registering for E-Tin in Bangladesh.

You can calculate yo. In order to obtain a User ID and password to open an account a phone number needs to be provided to the portal. Iklan Tengah Artikel 2.

Choose the online account application form and clicks the link Click here. It has one of the largest In. From the homepage Taxpayer clicks Register Account tab.

Iklan Tengah Artikel 1. In Bangladesh withholding taxes are usually termed as Tax deduction and collection at source. The National Board of Revenue NBR is the apex authority for tax administration in Bangladesh.

Update your tax payment. In Bangladesh individual income tax return filing is mandatory for both resident and non-resident Bangladeshi imposed by The National Board of Revenue NBR. A taxpayer can file an appeal against DCTs order to the Commissioner AppealsAdditional or Joint Commissioner of Taxes Appeals and to the Taxes Appellate Tribunal against an Appeal order.

Newer Post Older Post Home. It is a system guided easy-to-use tax preparation software that. How to open tax file in bangladesh Saturday March 5 2022 Edit.

You know from the last income year the tax day in Bangladesh is observed on 30 November of each Calendar year by the NBR. As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 if the taxable income is upto BDT 1500000. If any person fails to file return of income to the NBR without any reasonable cause then the person will be liable for penalty under the income tax ordinance 1984.

How to calculate Online Income Tax Return using Online User ID and Password and process of filing all the interfaces using Mozilla FirefoxInternet Explorer. Log in to the Online Filing System. In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income.

You might need to register for new eTIN numbers online. Pay your tax online. Taxpayer accesses the address httpetaxnbrgovbd.

880 17 11 314156. 13 Tax withholding functions.

Bsec Speeds Up Ipo Approval Process Securities And Exchange Commission Business Pages Capital Market

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Vcfiling In 2022 Opening A Bank Account Legal Business Helping People

Plastic Pollution In Bangladesh A Review On Current Status Emphasizing The Impacts On Environment And Public Health

Cash Bill Format Submited Images Pic 2 Fly Invoice Format Invoice Design Template Invoice Design

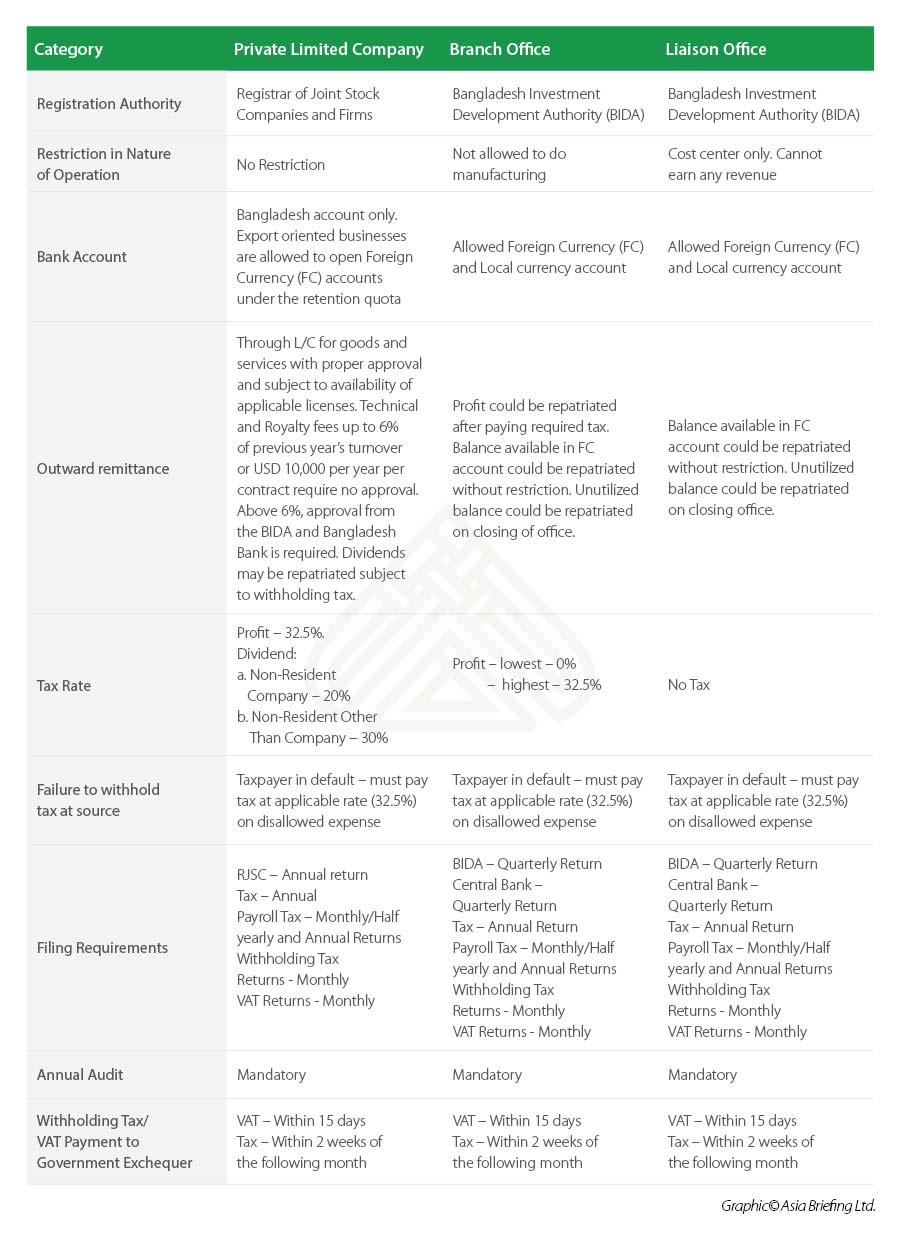

Starting A Business In Bangladesh Common Legal Entity Options

Victory Day Of Bangladesh Bangladesh Flag Victorious Bangladesh

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Pin By Vcfiling On Vcfiling Good People Wise Math

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Rana Plaza One Year On From The Bangladesh Factory Disaster Bangladesh The Guardian

Bangladesh Tax Return Filing And Tax Payment Relief Kpmg United States

Pharmacy Medicine Shop Flyer Vol 01 Corporate Identity Template Flyer Template Flyer Pharmacy Medicine

How Do Get An Affordable Truck Rental Price In Bangladesh Salute Piastrelle

Canada Visa From Bangladesh How To Apply For Canada Visitor Visa Application And Requirements Guide Visa Reservation

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

India Bank Hack Similar To 81 Million Bangladesh Central Bank Heist Union Bank Bank Union